Corporate Insolvency Regimes

Project Stream 1 · Jannis Poetzsch-Heffter

The comparative analysis of corporate insolvency law concerns plan voting schemes and priority regimes. Debt restructuring implies financial rescue in a situation of financial distress. However, it might also serve more broadly as a turning point—a reorientation of the corporation and its role within economy and society. Plan voting schemes, e. g., voting rights, majority thresholds, cram-down, establish the procedural conditions under which stakeholders can collectively agree on a restructuring plan. Priority regimes decide upon the ranking of a wide range of debt relations in insolvency, including derivatives, secured credit, employee wages, taxes, or new financing granted during restructuring. The ranking of creditors guides the distribution of assets among creditors in insolvency. Priority decisions between creditors become necessary since insolvent corporations cannot fully satisfy all claims. The comparative sample reveals the diverse social rationalities behind insolvency law and how legal orders resolve debt conflicts between debtor, creditors and other stakeholders. Ultimately, the analysis highlights the reflective capacity of insolvency law: priority regimes and plan voting schemes mediate and balance competing social rationalities.

Priority Regimes

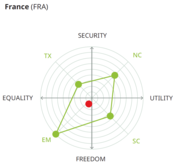

To compare priority regimes around the world, this research examines the ranking of the 14 most important types of debt relations in insolvency across 27 jurisdictions. The results are presented in graphics to illustrate differences and similarities across jurisdictions, as shown in the examples.

Normative Balancing Decisions

The illustration shows normative balancing decisions of four selected jurisdictions by means of a structural matrix of political values. The green four-sided figure illustrates how jurisdictions balance between the four key debt relations in insolvency, which are employee claims (EM), secured credit (SC), new credit granted during a rescue proceeding (NC) and taxes (TX). The red point signifies the basic normative orientation of the jurisdiction.

Project Funding

Funded by the European Union (ERC, RESOLVENCY, No. 950427). Views and opinions expressed are, however, those of the author(s) only and do not necessarily reflect those of the European Union or the European Research Council Executive Agency. Neither the European Union nor the granting authority can be held responsible for them.